YOUR SKILLS

OUR CAPITAL

Funding Traders Since 2021

No Time Limits, 1-Step Funding, $2,000,000

Funding Traders Since 2021, No Time Limits, 1-Step Funding, $2,000,000

Investing in traders from 2021

Engaged community of committed traders

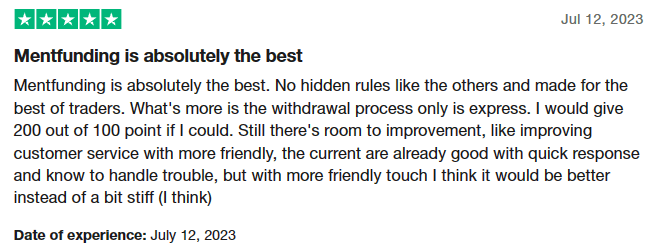

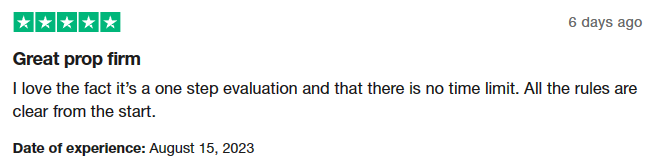

Clear rules with no hidden details

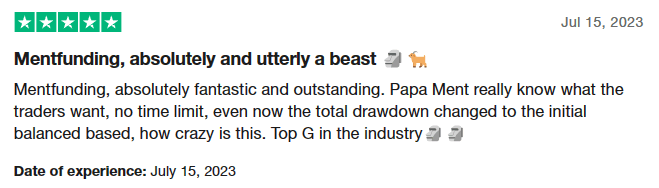

No minimum or maximum trading days

funding up to $2,000,000

no minimum trading days. No maximum trading days. Pass same day or take your time.

See the evaluation rules

why choose ment funding?

see how we compare to other prop firms

FOREX

$6 ROUNDTRIP

COMMODITIES

$0 ROUNDTRIP

INDICES

$0 ROUNDTRIP

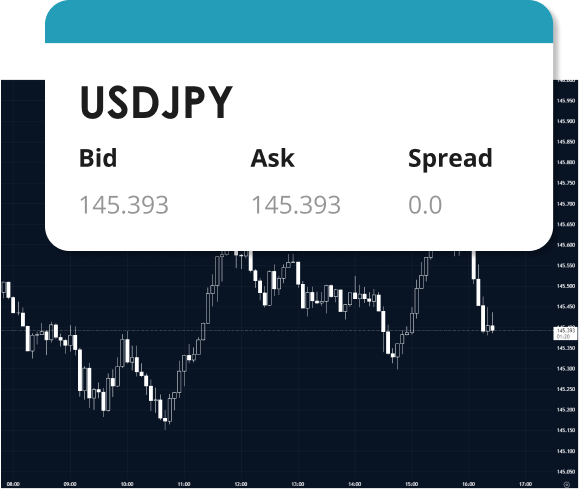

Trade with raw spread

We work with an extremely reputable and well-established, regulated broker: eightcap.

All spreads on all tradeable instruments are provided by eightcap under its raw account spreads starting as low as 0.0 pips on Majors.

Raw spreads will allow you to execute your trades regardless of the timeframe. Trade your system without any limits.

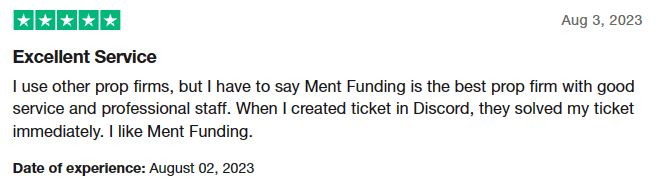

dedicated 24 / 7 support

If you have any questions, please don’t hesitate to reach out to our support staff on Discord (click here to join).

We encourage you to review the RULES and FAQ section, as it covers many common questions. If you can’t find the answers you need, we’re more than happy to help – just send us a message.

Anton Calmes, the CEO of Ment Funding, is actively involved and available on Discord, the YouTube community page, and with the Ment Funding team. We’re always here and ready to assist you!

If you have any questions, please don’t hesitate to reach out to our support staff on Discord (click here to join).

We encourage you to review the RULES and FAQ section, as it covers many common questions. If you can’t find the answers you need, we’re more than happy to help – just send us a message.

Anton Calmes, the CEO of Ment Funding, is actively involved and available on Discord, the YouTube community page, and with the Ment Funding team. We’re always here and ready to assist you!

Join our Discord server where you can connect with like-minded individuals, share your thoughts, and get priority support!

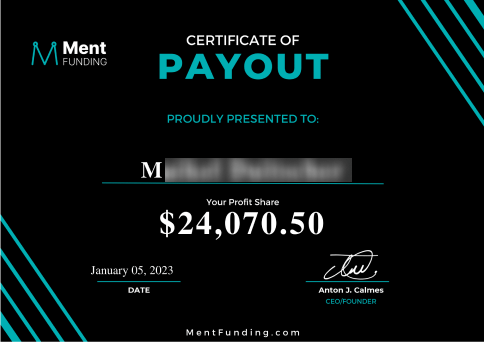

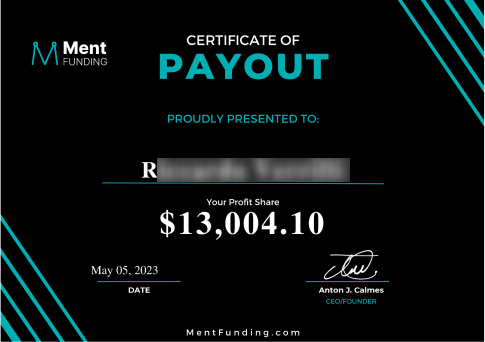

your success - our success

your success

our success

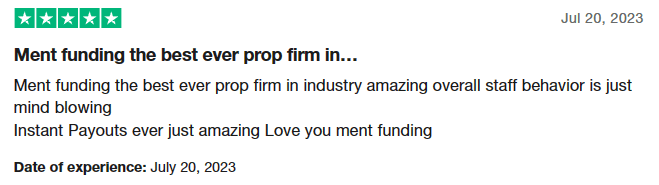

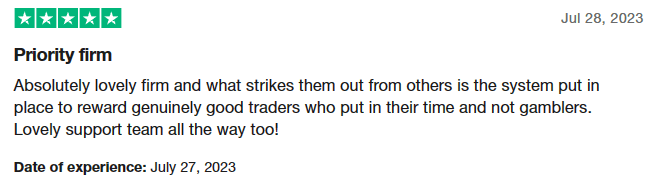

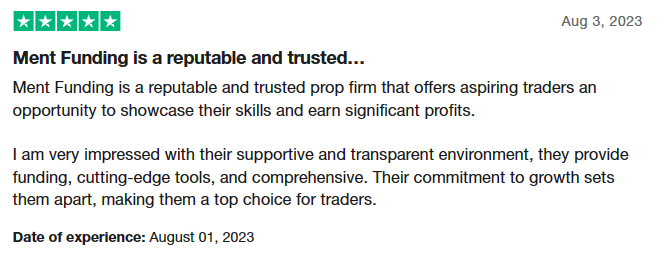

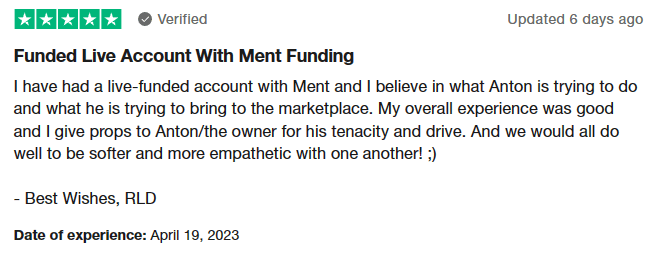

Ment Funding - The trusted choice for dedicated traders

THE EVOLUTION OF FOREX PROP FIRMS:

THE MENT FUNDING JOURNEY

how we built the trading ecosystem

In a world where genuine trading education was lacking and opportunities for aspiring traders were limited, the idea of Ment Funding was born. Our journey started with the creation of mentfx.com, a trading education company that bridged the educational gap in the market. It was about more than just teaching; it was about empowering traders with real knowledge and tools to succeed.

But education was only part of the puzzle. We realized that many talented traders were being overlooked, unfairly evaluated, and taken advantage of by traditional 2-step funding models. That’s why Ment Funding was conceived. We wanted to provide a fair chance for those people to get funded and evaluated in a way that respects their skills and potential. We set ourselves on a mission to create one of the best prop trading firms.

Our model is built around simplicity and fairness. There are no hidden rules or complex steps. You trade what you want, how you want when you want. We offer a 1-step evaluation, and if you pass, you get funded with real money. Our rules are transparent, and our approach is straightforward. If the rule isn’t here, you are in the clear. There’s no risk – take your time when taking a challenge. Ment Funding is one of the first prop firms with no time limit.

This isn’t just for mentfx.com students, though our foundation in education ensures that those who seek to learn have the resources to do so. This is for anyone with the skills and determination to succeed in trading. We’ve crafted an ecosystem where we educate, support, and collaborate with a diverse pool of traders who share our vision. Recognizing the distinct requirements of each trader, we provide access to 300+ trading instruments, encompassing Currencies, Indices, Commodities, Stocks, and Cryptos.

We fund traders, and your freedom is our strategy. With Ment Funding, we’ve eradicated the constraints that often hamper traders in other environments. No minimum days or maximum days to pass. No restrictions on your trading style, be it EA’s, Hedging, News, etc. You have the power to create your trading journey the way you envision it.

We’re proudly providing trading capital for traders. But Ment Funding is more than a prop firm. It’s a community of passionate traders who want to redefine the industry standards. Get funded for trading starting today.

rules and faq

If the rule isn’t in the Terms & Conditions, you are in the clear.

All Rules of the Evaluation are the EXACT SAME on the Funded Account.

Unlike other prop trading firms (proprietary trading firms), there are 0 hidden rules. All parameters for the evaluation and the funded account are the SAME and can be found on this page.

Please make sure to take the time to read every rule below. We are building a firm that focuses on your success, part of that is bringing on traders that understand exactly how we operate. We want you to succeed and become a funded trader.

There are only 3 ways to breach and lose an account, please read below for more details:

- Max Loss

- Daily Max Loss

- Inactivity of 30 days (if you do not place a trade at least once every 30 days on your account, Eightcap/Ment Funding will consider the account INACTIVE and the account will be breached) – you are free to place a 0.01 lot (open then close) to keep your account active.

To help you get started and avoid accidental actions, such as unintentionally closing a position, we recommend taking some time to familiarize yourself with the platform’s features.

We’ve found some excellent resources on the GooeyTrade YouTube channel. Specifically, there’s a DxTrade playlist that walks through key features and tools of the platform in detail.

In addition to DxTrade, the channel offers playlists covering platforms like MatchTrader and cTrader. These videos provide valuable insights and practical tips to help you navigate each platform effectively.

We highly recommend checking out these resources to enhance your trading experience!

- Soft breach means that we will close all trades that have violated the rule. However, you can continue trading in your Assessment or Funded Account.

- Hard breach means that you violated either the Daily Loss Limit or Max Trailing Drawdown rule. Both rules constitute a hard breach. In the event you have a hard breach, you will fail the Assessment or have your Funded Account taken away.

The Daily Loss Limit is the maximum your account can lose in any given day. Daily Loss Limit is calculated using the previous day balance which resets at 5 PM EST. Unlike other firms, we do NOT base our calculations on previous day equity since the balance only model allows you to scale profits without fear of losing your account. The Daily Stop compounds with the increase in your account.

Example: if your prior day’s end of day balance (5pm EST) was $100,000, your account would violate the daily stop loss limit if your equity reached $95,000 during the day. If your floating equity is +$5,000 on a $100,000 account, your new- day (5pm EST) max loss is based on your balance from the previous day ($100,000). So, your daily loss limit would still be $95,000.

The Maximum Trailing Drawdown is initially set at 6% and trails (using CLOSED BALANCE – NOT equity) your account until you have achieved a 6% return in your account. Once you have achieved a 6% return the Maximum Trailing Drawdown no longer trails and is permanently locked in at your starting balance. This allows for more trading flexibility.

Example: If your starting balance is $100,000, you can drawdown to $94,000 before you would violate the Maximum Trailing Drawdown rule. Then for example let’s say you take your account to $102,000 in CLOSED BALANCE. This is your new high-water mark, which would mean your new Maximum Trailing Drawdown would be $96,000. Next, let’s say you take your account to $106,000 in CLOSED BALANCE, which would be your new high-water mark. At this point your Maximum Trailing Drawdown would be locked in at your starting balance of $100,000. So, regardless of how high your account goes, you would only breach this rule if your account drew back down to $100,000 (note, you can still violate the daily drawdown). For example, if you take your account to $170,000, as long as you do not drawdown more than 5% in any given day, you would only breach if your account equity reaches $100,000.

We believe sound risk management using stop losses. To that end, we require a stop loss on every trade. If you fail to place a stop loss at the time of placing the trade/order, we will close the trade. This is only a soft breach rule, so you can continue trading in your account.

We require all trades to be closed by 3:45pm EST on Friday. Any trades left open after this time will automatically be closed. Note, this is only a soft breach and you will be able to continue trading once the markets reopen.

- Forex – 1 lot = $100k notional

- Index – 1 lot = 10 Contracts

- Cryptos – 1 lot = 1 coin

- Stocks – 1 lot = 100 shares

- Silver – 1 lot = 5000 ounces

- Gold – 1 lot = 100 ounces

- Oil – 1 lot = 1000 barrels

Below are the maximum open lots across all pairs that a trader can have at any given time.

- $25K – 2.5 lots with risk

- $50K – 5 lots with risk

- $100K – 10 lots with risk

- $250K – 25 lots with risk

- $500K – 50 lots with risk

- $1 million – 100 lots with risk

For example, if you are in the $100k plan, you will be able to have 10 open lots with risk available.

If you buy 5 lots of EURUSD at 1.20 and your stop loss is at 1.18, you will have 5 lots on with risk, so you would have 5 still available. If the EURUSD moves up to 1.25, and you update your stop loss to be at 1.20, which would be your open price, you no longer have risk on that trade. So, you would again have 10 lots available, even though you currently have 5 lots open.

If you put on too many lots with risk, then our system will liquidate all trades that currently have risk.

Please note, margin and leverage requirements still apply. So, even though these are the maximum lots that can be traded, it is possible based on the leverage of the account that you may not be able to trade up the maximum.

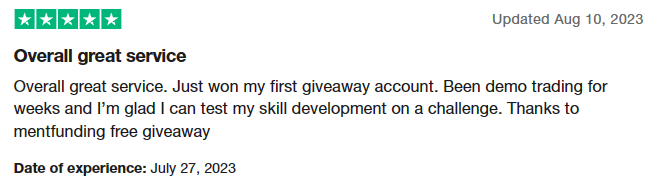

Ment Funding traders are given the freedom to customize their own 1-step evaluation.

On the checkout page after clicking “Select Plan” in our Evaluation section above, members will have the ability to choose to pay extra for “upgrades” in their evaluation, making their evaluation fine-tuned to their own system. These upgrades will include the following and will see a price increase as addressed below:

- Hold over the weekend – 10% price increase

- Double Leverage (this will double all FX and metals leverage to up to 1:20, as well as double max open lots available) – 25% price increase

- No Stop Loss Required – 10% price increase

- 90% Profit Split – 20% price increase

Note: you can forgo all options and pay original price, or you can mix and match options; select 1 option, or select all.

Instead of increasing price, since Ment Funding seeks to find the highest end of traders across all trading types, we seek to provide the opportunity for our algorithmic based traders, manual based traders, higher timeframe or longer term based traders, and our lowertime frame and scalp based traders to pick the evaluation right for them.

We work with a company called Deel to issue trader agreements and process withdrawals of gains in your Funded Account. Upon passing your Assessment, you will receive an email from Deel with instructions on how to access and complete your Trader Agreement. Once the agreement is completed and supporting documentation is provided, your Funded Account will be created, funded and issued to you typically within 24-48 business hours.

Once you pass the Assessment, we provide you with a live account, backed by our capital. The capital in your Funded Account is notional and may not match the amount of capital on deposit with the Broker. A Funded Account is notionally funded when actual funds in the account (i.e., the equity in a Funded Account represented by the amount of capital) differs from the nominal account size (i.e., the size of the Funded Account that establishes the initial account value and level of trading). Notional funds are the difference between nominal account size and actual capital in a Funded Account.

Use of notional funding does not change the trading level or that the account may trade in any manner differently than if notional funds were not used. In particular, the same conditions and rules applicable to a soft breach, hard breach, Daily Loss Limit, Max Trailing Drawdown, stop loss and position limits apply.

Credentials and links will be sent directly to your email along with downloads to the trading software immediately after payment is processed (usually 15-30 minutes). You can also access the Trader Dashboard using the ‘Dashboard’ button above.

The Max Lot Size rule stays the same for the assessment account.

For our Funded Traders operating on their live accounts, we offer the following scaling rule:

We will increase your Max Lot Size on the account with each 5% increase on your account, allowing the highest end of traders to not only compound their accounts, but to also increase their scalability with higher leverage.

This is done manually on our backend. As you grow an account and compound your earnings, if you want to continue growing that account and do so with a higher max lot size, please reach out to us at [email protected] or using the Contact Us tab. Once you have reached out, we will check to see the percentage your account is up from its original starting balance, and increase the lot size respective to the account size.

Example: You have a funded live $100,000 account with Ment Funding. You grow that account to $115,000. If you email us as a funded member and ask for increased lot size, we will increase your max lot size from 10 lots, to 11.5 lots – complimenting the 15% growth in your account.

This is done to incentivize our traders to build up accounts and build up large sums of capital that they can manage for us. As they build that account, they unlock higher and higher max lot sizes tradeable on that account allowing for them to scale the profits they make and the rate at which they make them.

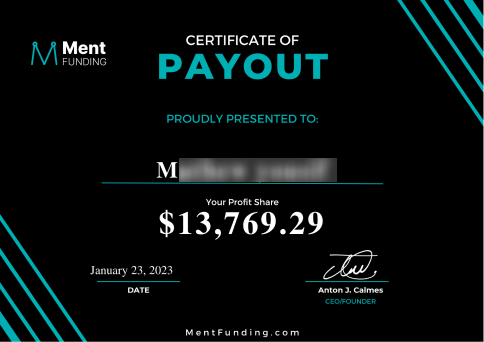

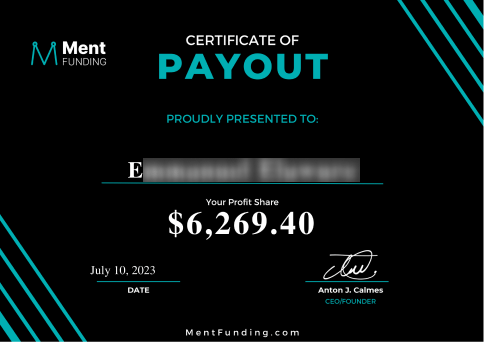

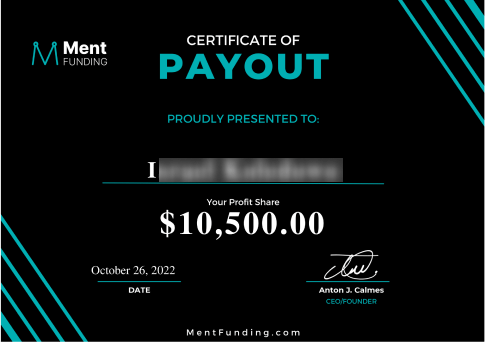

You have the freedom of choosing your first payout whenever you’d like. You can choose not to ask for a payout and infinitely compound your account. Unless you customized your evaluation and added the 90/10 profit split as an upgrade at the checkout page – the profit split is 75/25 with the trader (you) keeping 75% of withdrawn profits. We limit you to 1 payout every 30 days, however, your first payout can be any day you choose.

REQUEST PAYOUT: Ment Funding works with a company called Deel to issue trader agreements and process withdrawals of profits. Upon passing your Assessment, you will receive an email from Deel with instructions on how to access and complete your Trader Agreement. Once the agreement is completed and supporting Know Your Customer documents provided, your funded account will be created, funded and issued to you typically within 24-48 business hours.

Example: you have a $100,000 funded account. You earn $15,000 on it and are now at $115,000, one day into trading your funded account. You may request withdrawal instantly via email ([email protected]).

Important: See 6% Max Loss Rule above. Upon your first withdrawal, the accounts Max Loss locks at the original accounts starting value.

Example: you have a $400,000 funded account. You earn $60,000 on the account and are now at $460,000. Upon requesting a withdrawal, the Max Loss moves up from its original 6%, to being locked in at the ORIGINAL balance. Meaning if your account hits $400,000 you will lose the account, so it’s always smart to 1) Compound your account before the first withdrawal and 2) always leave a buffer to retain the account.

When you are ready to withdraw your profits, please send an email to [email protected] requesting the amount you would like to withdraw. We will then post your profit share into your Deel account, which you can withdraw via any of the available methods they offer (wire transfer, PayPal, Payoneer, Coinbase, Revolut, ACH and other popular methods)

EA’s, Copy Traders, Scripts, and Indicators are all allowed.

There are 3 ways to lose an account: 5% Max Daily Stop Rule, the 6% Max Loss Rule, or after an inactivity period (not opening or closing a trade) of 30 days.

We are a no minimum trading days prop firm, but you must maintain an active account by opening at least one trade every 30 days.

Yes. If you do not place a trade at least once every 30 days on your account, we will consider you inactive and your account will be breached.

You are permitted to take 1 EVALUATION at a time.

With regard to the concept of ‘limits’ this is where we stand at present:

- $2 million max per person (can be made up of multiple assessments, provided none are same size at the same time).

- $2 million max per strategy/EA (can be made up of multiple assessments, provided none are same size at the same time). Note: This applies to “off-shelf” EA’s (EA’s purchased from the market and used by many) We are seeking to fund independent and unquiet strategies not 1 that is the exact same across the board.

There is NO limit to how many accounts you may have (as long as it’s within the $2 million limit). We provide prop firm funding and there is NO limit for compounding. Up to $2 million of initial funding, then grow the account to any balance you desire – yes, even $10 million, $20 million, and so on.

All markets offered here (all offered through Eightcap) will be tradeable with our proprietary firm. We offer Currencies, Indices (including DXY, VIX), Commodities, Cryptocurrencies (over 200+), and Individual Shares. Please make yourself aware of any broker side limitations regarding risk and depth of market as Ment Funding has no control over these things.

Once you have received your account, please make sure to “Show All” pairs in the terminal. The tradeable forex pairs are the “.i” pairs. Example: EURUSD.i, AUDUSD.i,US30.i

Tradeable Indexes and Cryptos will be found as “.p” pairs. Example: BTCUSD.p, ETHUSD.p

Leverage: Forex, Metals, Oils, and Indices (1:10), Crypto Currencies (1:2), CFD/Stocks (1:5)

Specification: 1 lot in Forex = 100,000 units, 1 lot in Crypto = 1 coin, 1 lot in Indices = 10 units,

1 lot in Stocks = 100 shares (CFD), 1 lot in Commodities = 100 units (this can also be seen on Eightcaps website as well as right clicking the market you are trading and pressing Specification in the Trading Platforms terminal.

Slippage: Although Eightcap has extremely good depth of market on most of its offered pairs/markets, there are some exceptions – these are entirely handled by Eightcap, and Ment Funding has no control over depth of market or broker pricing or ANY broker related services. Crypto’s offered with Ment Funding via Eightcap are offered as a CFD and not as a DEX product – so you may experience higher slippage as you trade larger lot sizes – This is true regardless of the broker executing the trades, but please make sure you are aware of how slippage works and can impact your trading.

Get funded trading Forex, commodities, metals, stocks – any instrument or market of your choice. Whether you’re looking for prop firm for stocks, commodities or Forex trading firms – Ment Funding can offer it to you.

Yes. As long as you are trading within the permitted 1:10 leverage and lot size (seen in your dashboard upon purchase) you may hedge positions on both sides. We want to give you wide capital trading opportunities.

If you have moved your trade to Breakeven (stop loss locking in a profit on the overall position) your lots will be freed up and can be used to hedge as well.

Example: You have a $100,000 account and are trading EUR/USD. EUR/USD is at a current price of 1.11000 (estimation, make sure to use the price of an asset at the time of your calculation.

You are able to take at max $100,000 * (leverage) =

$1,000,000/1.11000 (E/U price) =

$900,900 / $100,000 (size of a standard lot) = 9.009

= 9.00 lots max.

This means if you enter a BUY on EUR/USD for 9 lots, you will only be able to hedge EUR/USD for 1 lot, as the Maximum Lot Size with Risk permitted is 10 lots. However, if after it begins to go up, you move your Stop Loss to above the entry price (putting you in profit), you will now be able to enter a SELL on EUR/USD for up to 10 lots. Keep in mind that hedging a position helps to reduce the required margin as the Trading Platform is a netting platform, however hedging is independent of the Maximum Lot Size with Risk. Also, moving a stop-loss to breakeven will free up additional lots to be used against the Maximum Lot Size with Risk, however this will not free up additional margin to be traded. Margin and Lot Size with Risk are two independent criterion that must be met.

We work with an extremely reputable and well-established, regulated broker: eightcap . All spreads on all tradeable instruments are provided by eightcap under its raw account spreads starting as low as 0.0 pips on Majors.

For FX, commissions are $3.00 each way, that’s $6 per lot round trip on a trade – that is lower than clients of eightcap directly get, we are able to negotiate lower commissions while retaining the same raw feed, making Ment Funding a great option for someone that may not have access to eightcap as a broker and/or wants to trade with lower commissions.

We aim to provide the best funding for Forex, stocks, commodities and crypto traders.

Currently, all accounts are opened with eightcap on the Trading Platform. Trading platform download link will be made accessible to you and sent to you with credentials after your payment is processed (15-30 minutes) and will also be accessible once logged into the dashboard.

You can also download the software directly from the website here.

Although eightcap may not be available in your specific country, you will be permitted to trade with the broker through Ment Funding.

We accept people from almost any country, with only certain exclusions: Iran, Iraq, and Ivory Coast. If your country is not mentioned, check out our funded trader programs and select your plan.

In our terms and conditions, you will see a better outline of these rules (view upon purchasing your evaluation). Note: less that 0.2% of prop firm clientele fall under this – there is a 99.80% chance this does not apply to you – we include it because there are those that take advantage of mispricing between demo and live environments, build out EA’s that only work in full demo environments, etc. – these people know who they are, you do not need to worry about it.

If we detect that your trading constitutes Malicious Practices your participation in the program will be terminated and may include forfeiture of any fees paid for your Evaluation. Additionally, and before any Trader shall receive a funded account, the trading activity of the Trader under these Terms and Conditions shall be reviewed by us to determine whether such trading activity constitutes Malicious Practices. In the case of Malicious Practices, the Trader shall not receive a funded account.

Simply put, taking advantage of arbitrage pricing or latency is against the rules. Malicious practices like latency pricing used to benefit in a demo environment that can’t be used in a live environment is against the rules.

This includes, but may not be limited to:

- Exploiting errors or latency in the pricing and/or platform(s) provided by the Broker

- Utilizing non-public and/or insider information

- Front-running of trades placed elsewhere

- Trading in any way that jeopardizes the relationship Prop Account has with a broker or may result in the canceling of trades

- Trading in any way that creates regulatory issues for the Broker

- Utilizing any third-party strategy, off-the-shelf strategy or one marketed to pass assessment accounts

- Utilizing one strategy to pass an assessment and then utilizing a different strategy in a funded account

- Buying accounts for the purpose of “all-inning” over and over again until hitting it big is prohibited

- Holding a stock (equity CFD) into earnings/economic releases is prohibited

There are a number of companies marketing and selling off-the-shelf EA’s aimed at passing Evaluations/Funded Challenges. This is NOT a representation of a profitable trader and falls under Malicious Practices.

We are not a new prop firm. We take these actions in order to protect the business model behind Ment Funding and aim to enforce our main company philosophy, “serious funding for serious traders.” Those executing using malicious EA’s and/or strategies that are marketed for passing evaluations (this mostly affects less than 0-3% of our customer base), will fall under Malicious Practices and will be refunded a portion of their initial payment. They will be barred from ever using Ment Funding or any of its services ever again.

Most of the FM prop trading firms offer a two step evaluation model. You have to pass the challenge, and then you need to pass the evaluation. You need to generate a certain amount of profit twice.

At Ment Funding we are transparent, and we are a one step evaluation prop firm (sometimes referred as one step challenge prop firm).

Your goal is to generate 10% profit following our rules.

Make sure you review the rules carefully and see how Ment Funding compares to other remote trading firms.