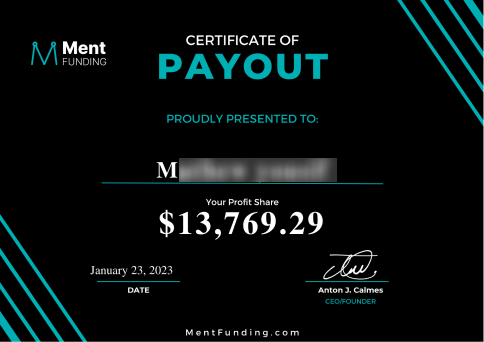

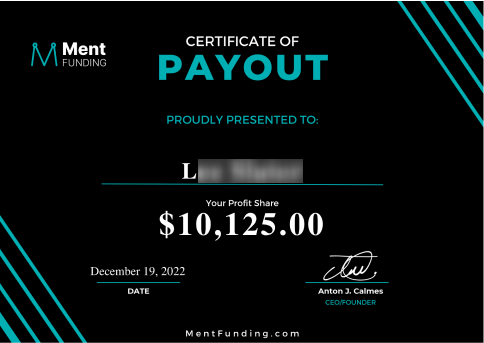

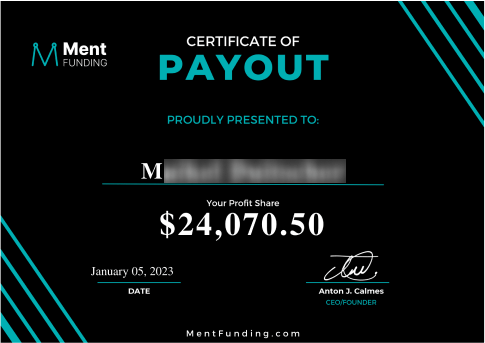

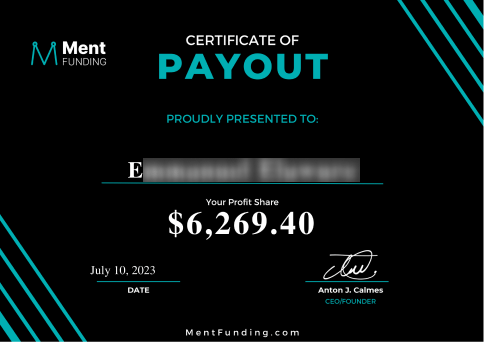

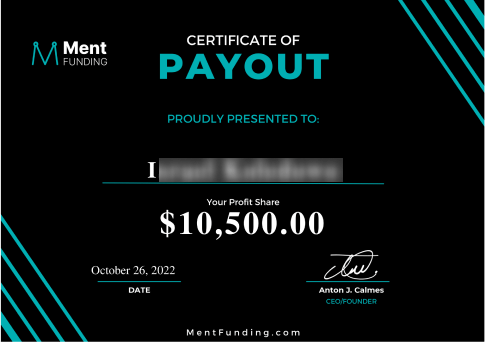

Trusted by Traders

Proven by Payouts

Funding Traders Since 2021

No Time Limits, 1-Step Funding, $2,000,000

Funding Traders Since 2021, No Time Limits, 1-Step Funding, $2,000,000

Investing in traders from 2021

Account scaling up to $5,000,000

Clear rules with no hidden details

No minimum or maximum trading days

funding up to $2,000,000

Scaling up to $5,000,000

no minimum trading days. No maximum trading days. Pass same day or take your time.

See the evaluation rules

why choose ment funding?

see how we compare to other prop firms

FOREX

$7 ROUNDTRIP

COMMODITIES

$0 ROUNDTRIP

INDICES

$0 ROUNDTRIP

Trade with raw spread

We work with a network of leading brokers to ensure superior execution.

All spreads on all tradable instruments are provided by our aggregate sources, offering raw account spreads starting as low as 0.1 pips on Majors.

Raw spreads will allow you to execute your trades regardless of the timeframe. Trade your system without any limits.

dedicated 24 / 7 support

If you have any questions, please don’t hesitate to reach out to our support staff on Discord (click here to join).

We encourage you to review the RULES and FAQ section, as it covers many common questions. If you can’t find the answers you need, we’re more than happy to help – just send us a message.

Anton Calmes, the CEO of Ment Funding, is actively involved and available on Discord, the YouTube community page, and with the Ment Funding team. We’re always here and ready to assist you!

If you have any questions, please don’t hesitate to reach out to our support staff on Discord (click here to join).

We encourage you to review the RULES and FAQ section, as it covers many common questions. If you can’t find the answers you need, we’re more than happy to help – just send us a message.

Anton Calmes, the CEO of Ment Funding, is actively involved and available on Discord, the YouTube community page, and with the Ment Funding team. We’re always here and ready to assist you!

Join our Discord server where you can connect with like-minded individuals, share your thoughts, and get priority support!

your success - our success

your success

our success

Ment Funding - The trusted choice for dedicated traders

THE EVOLUTION OF FOREX PROP FIRMS:

THE MENT FUNDING JOURNEY

how we built the trading ecosystem

In a world where genuine trading education was lacking and opportunities for aspiring traders were limited, the idea of Ment Funding was born. Our journey started with the creation of mentfx.com, a trading education company that bridged the educational gap in the market. It was about more than just teaching; it was about empowering traders with real knowledge and tools to succeed.

But education was only part of the puzzle. We realized that many talented traders were being overlooked, unfairly evaluated, and taken advantage of by traditional 2-step funding models. That’s why Ment Funding was conceived. We wanted to provide a fair chance for those people to get funded and evaluated in a way that respects their skills and potential. We set ourselves on a mission to create one of the best prop trading firms.

Our model is built around simplicity and fairness. There are no hidden rules or complex steps. You trade what you want, how you want when you want. We offer a 1-step evaluation, and if you pass, you get funded. Our rules are transparent, and our approach is straightforward. If the rule isn’t here, you are in the clear. There’s no risk – take your time when taking a challenge. Ment Funding is one of the first prop firms with no time limit.

This isn’t just for mentfx.com students, though our foundation in education ensures that those who seek to learn have the resources to do so. This is for anyone with the skills and determination to succeed in trading. We’ve crafted an ecosystem where we educate, support, and collaborate with a diverse pool of traders who share our vision. Recognizing the distinct requirements of each trader, we provide access to a wide range of trading instruments.

We fund traders, and your freedom is our strategy. With Ment Funding, we’ve eradicated the constraints that often hamper traders in other environments. No minimum days or maximum days to pass. No restrictions on your trading style, be it EA’s, Hedging, etc. You have the power to create your trading journey the way you envision it.

We’re proudly providing trading capital for traders. But Ment Funding is more than a prop firm. It’s a community of passionate traders who want to redefine the industry standards. Get funded for trading starting today.

rules and faq

If the rule isn’t in the Terms & Conditions, you are in the clear.

All Rules of the Evaluation are the EXACT SAME on the Funded Account.

Unlike other prop trading firms (proprietary trading firms), there are 0 hidden rules. All parameters for the evaluation and the funded account are the SAME and can be found on this page.

Please make sure to take the time to read every rule below. We are building a firm that focuses on your success, part of that is bringing on traders that understand exactly how we operate. We want you to succeed and become a funded trader.

There are only 4 ways to breach and lose an account, please read below for more details:

- Violating the Max Daily Stop Rule.

- Exceeding the Max Loss Rule.

- Inactivity: Not opening or closing a trade for a continuous period of 30 days.

- Prohibited Practices: Accounts may be removed from the program if an individual is found to be engaging in activities deemed prohibited.

Available platforms are: cTrader, DXtrade and MTR.

We recommend the client take some time to learn about the platform so they do not accidentally close any position they do not mean to.

We also have a YouTube playlist dedicated to our instance of DxTrade.

We highly recommend they watch the playlist to learn more about the available platform: https://www.youtube.com/@GooeyTrade/playlists

- Soft breach means that we will close all trades that have violated the rule. However, you can continue trading in your Assessment or Funded Account.

- Hard breach means that you violated either the Daily Loss Limit or Max Drawdown rule. Both rules constitute a hard breach. In the event you have a hard breach, you will fail the Assessment or have your Funded Account taken away.

The Daily Loss Limit is the maximum your account can lose in any given day. Daily Loss Limit is calculated using the previous day balance which resets at 5 PM EST. Unlike other firms, we do NOT base our calculations on previous day equity since the balance only model allows you to scale profits without fear of losing your account. The Daily Stop compounds with the increase in your account.

Example: if your prior day’s end of day balance (5pm EST) was $100,000, your account would violate the daily stop loss limit if your equity reached $95,000 during the day. If your floating equity is +$5,000 on a $100,000 account, your new- day (5pm EST) max loss is based on your balance from the previous day ($100,000). So, your daily loss limit would still be $95,000.

The Max Daily Loss is subtracted from end of day balance. It is the maximum your account can lose in any given day. Withdrawing profit on your funded account does not affect the Max Daily Loss.

Max Daily Loss is calculated using the previous day balance which resets (re-calculates) at 5 PM EST. Unlike other prop firms, we do NOT base our calculations on previous day equity since the balance only model allows you to scale profits without fear of losing your account. The Max Daily Loss compounds with your account.For example, on a $100,000 account, the Max Daily Loss = $95,000 ($100,000 – $5000 [5% Max Daily Loss] = $95,000).

So if your equity on any given day is $106,000 but the balance is still $100,000, the Max Daily Loss breach level is still $95,000. If you closed the trade in profit before 5 PM EST, at 5 PM EST the calculation resets and the Max Daily Loss = $100,700 ($106,000 – $5300 [5% Max Daily Loss]).

This is also updated and shown in your Trader Dashboard along with other metrics so you can keep track of it with no issues.

Another Example: if your prior day’s end of day balance (5pm EST) was $100,000, your account would violate the daily stop loss limit if your equity reached $95,000 during the day. If your floating equity is +$5,000 on a $100,000 account, your new-day (5pm EST) max loss is based on your balance from the previous day ($100,000). So, your daily loss limit would still be $95,000.

The Max Loss is static and calculated ONLY on initial Balance. For example, on a $100,000 account, the account can only be breached if it goes below $94,000 (6%). So if your balance grows to $107,000 on a $100,000 account, the Max Loss is still $94,000 (6% from the original balance).

Important Note: the Max Loss moves to the initial balance after the first withdrawal – incentivizing our funded traders to compound and grow their accounts before withdrawing huge earnings (please see below example).

Example: If you have a $200,000 account, the Max Loss Breach level would be $188,000. If you then traded your account up to $215,000, the Max Loss Breach level would still be $188,000 (6% of the initial balance). If you then withdrew $10,000 as profit, upon your first withdrawal, the Max Loss locks in at the ORIGINAL account balance. So after withdrawing $10,000, your account will have a balance of $205,000 and the breach level is now $200,000, meaning you now have a buffer of $5,000. Similarly, if you withdrew $15,000, your account balance would now be $200,000 which is also the BREACH level, meaning you would lose your funded account.

Further Example: If you continued to compound your $200,000 all the way to $300,000, the Max Loss Breach Level is still $188,000. However, if you then withdrew $50,000 profit, the Max Loss will lock in at $200,000, meaning you would now have $50,000 as a buffer (Max Loss).

We have included this rule to incentivize our funded traders to compound their accounts, ensuring that they have a hefty buffer, can pay themselves out as they see fit, and continue trading with Ment Funding as a Ment Funded member.

We require all trades to be closed by 3:45pm EST on Friday. Any trades left open after this time will automatically be closed. Note, this is only a soft breach and you will be able to continue trading once the markets reopen.

- Forex – 1 lot = $100k notional

- Index – 1 lot = 1 Contracts

- Silver – 1 lot = 5000 ounces

- Gold – 1 lot = 100 ounces

- Oil – 1 lot = 100 barrels

Yes. If you do not place a trade at least once every 30 days on your account, we will consider you inactive and your account will be breached.

There are four ways an account can be lost:

- Violating the Max Daily Stop Rule.

- Exceeding the Max Loss Rule.

- Inactivity: Not opening or closing a trade for a continuous period of 30 days.

- Prohibited Practices: Accounts may be removed from the program if an individual is found to be engaging in activities deemed prohibited.

While we are a no-minimum-trading-days prop firm, maintaining an active account requires opening at least one trade every 30 days.

Ment Funding traders are given the freedom to customize their own 1-step evaluation.

On the checkout page after clicking “Select Plan” in our Evaluation section above, members will have the ability to choose to pay extra for “upgrades” in their evaluation, making their evaluation fine-tuned to their own system. These upgrades will include the following and will see a price increase as addressed below:

- Hold over the weekend – 10% price increase

- 90% Profit Split – 20% price increase

Note: you can forgo all options and pay original price, or you can mix and match options; select 1 option, or select all.

Instead of increasing price, since Ment Funding seeks to find the highest end of traders across all trading types, we seek to provide the opportunity for our algorithmic based traders, manual based traders, higher timeframe or longer term based traders, and our lowertime frame and scalp based traders to pick the evaluation right for them.

Upon passing your Assessment, you will receive an email with instructions on how to access and complete your Trader Agreement. Once the agreement is completed and supporting documentation is provided, your Funded Account will be created, funded and issued to you typically within 24-48 business hours.

Once you pass the Assessment, we provide you with a live account, backed by our capital. The capital in your Funded Account is notional and may not match the amount of capital on deposit with the Broker. A Funded Account is notionally funded when actual funds in the account (i.e., the equity in a Funded Account represented by the amount of capital) differs from the nominal account size (i.e., the size of the Funded Account that establishes the initial account value and level of trading). Notional funds are the difference between nominal account size and actual capital in a Funded Account.

Use of notional funding does not change the trading level or that the account may trade in any manner differently than if notional funds were not used. In particular, the same conditions and rules applicable to a soft breach, hard breach, Daily Loss Limit, Max Drawdown and position limits apply.

No. We operate at an arm’s length with the Broker. All market pricing and trade executions are provided by the Broker and are not changed or modified by us. Additionally, we do not mark up transaction costs established by the Broker through adjusting bid-offer spreads, markups/markdowns, commission charges or swaps.

For purposes of managing risk and minimizing transaction costs, we may offset or negate market risk and act as the direct counterparty to certain trades initiated in the Account. Such trades are executed at prices provided by the Broker. This framework is intended to ensure you receive real market execution on your trades, while simultaneously allowing us to manage risk dynamically by routing existing positions or future orders to third parties for execution as we deem appropriate. We believe that such real market execution and dynamic risk management would not be possible or as cost-effective if trades were executed in simulated accounts. Regardless of whether we act as a counterparty to your trades, the gain or loss on your Funded Account is not calculated differently. However, when we act as the counterparty to your trades, there is an inherent potential conflict of interest because your trades do not result in net gain or loss to us, as your trades would if we were not the direct counterparty.

We reserve the right to limit the number of open positions you may enter or maintain in the Funded Account at any time, and to revise in response to market conditions the drawdown levels at which trading in the Funded Account will be halted. We or the Broker reserve the right to refuse to accept any order.

The rules for the Funded Account are exactly the same as your Assessment account. However, with a Funded Account, there is no profit target.

If you have gains in your Funded Account at the time of a hard breach, you will still receive your portion of those gains.

For example, if you have a $100,000 account and you grow that account to $110,000. Should you then have a hard breach we would close the account. Of the $10,000 in gains in your Funded Account, you would be paid your portion thereof.

Traders can request a withdrawal of the gains in their Funded Account at any time in their trader dashboard, but no more frequently than once per thirty (30) days. So, if you make gain in your Funded Account, you can request a withdrawal. When you are ready to withdraw the gains from your Funded Account, click the Withdraw Profits button in your trader dashboard and enter the amount to withdraw.

You can choose to receive your payouts through one of our trusted partners.

Bank Transfers with Riseworks:

We have integrated with Riseworks, a leading provider of seamless payment solutions. If you select Riseworks as your payout option and provide a valid email address, you will receive a link to create your account. Once set up, you can transfer your payouts directly to your bank account.

Wallet Withdrawals:

We can process payments to your existing wallet via Columis.

We always try to process your requests as soon as possible, which is within 48 business hours of the request (but typically within 24 hours).

Your first withdrawal can be requested at any time. Thereafter, you can request a withdrawal of the gains in your account every 30 days. When a withdrawal is approved, we will also withdraw our share of the gains, and your max drawdown will lock in at your starting balance. The max drawdown does not reset when you request a withdrawal. Example: You have taken an account from $100,000 to $120,000. You then request a withdrawal of $16,000. In this scenario, you will receive $12,000 and we would retain $4,000. This would also take the balance of the account down to $104,000, and your Maximum Drawdown is locked in at $100,000. So, you would have $4,000 maximum you could lose on the account before it would violate the Maximum Drawdown rule. If you take a full withdrawal of the gains in your Funded Account, the Maximum Drawdown will still lock in at the starting balance and will therefore result in the forfeiting of your Funded Account, as your balance will trigger the Maximum Drawdown breach rule.

What happens when I meet the doubling conditions?

Once you meet all the conditions listed below, you’ll be paid out your profit split based on the profits left in the account. After that, the account will be closed and you’ll receive a brand new LIVE account with double the previous size.

Example: You’re on a $100,000 account. By the time you meet all requirements, the account has grown to $140,000. You get paid your profit split from the $40,000 gain, the $100,000 account is closed, and you’re issued a brand new LIVE $200,000 account with a 6% max loss. It’s a fresh account, just twice the size.

Requirements to Qualify:

Withdraw at least once on the account (we only start tracking once a withdrawal has been made).

Out of any 6-month period, at least 3 months must show a gain of more than 2% (they don’t need to be consecutive).

Total profits (current profit + any payouts on the account) must reach at least 10% of your starting balance.

Does this apply to both Forex and Futures accounts? Yes. These rules apply to both the Forex and Futures funding programs. Each is treated separately – you can max out funding on both sides independently.

Maximum Funding Limits:

You can scale up to $5,000,000 on the Forex side.

You can also scale up to $5,000,000 on the Futures side.

That means you can hold $1 million in funding on Forex and $375k on Futures, and still be eligible to scale both to their respective caps.

We have risk management software that is synced with the accounts we create. This allows us to analyze your performance in real time for achievements or rule violations. As such, you must use an account that we provide to you.

Subject to compliance with applicable laws and regulations, traders from all countries, excluding OFAC listed countries, can take part in our program.

You must be at least 18 years of age, or the applicable minimum legal age in your country, to purchase an assessment.

Upon purchasing an Assessment, you will receive access to a trader dashboard where you can monitor your Assessment and Funded Accounts. The dashboard is updated every time we calculate metrics, which occurs roughly every 60 seconds. It is your responsibility to monitor your breach levels.

Our risk management technology is currently integrated with the platforms we provide, which you will be able to download in the back office. These platforms, along with pricing and execution are provided by our Broker.

You can trade any products offered by the Broker, as such products may change from time to time. This includes FX pairs, Metals, Indices.

You can see the full list of products and commissions here – https://mentfunding.com/commissions-and-products/

Trading hours are set by the Broker. We do not have any control over the trading hours.

Please note that holidays can have an impact on available trading hours.

Additionally, pursuant to the no holding trades over the weekend rule, we close all open trades at 3:45pm EST on Fridays.

We use the RAW accounts from the Broker. These accounts have commission charges for Forex. The other products do not carry a commission.

EA’s, Copy Traders, Scripts, and Indicators are all allowed.

You’re allowed to run multiple evaluations at the same time, as long as each one is a different account size.

You can:

Trade multiple evaluations at once if they are different sizes (e.g., 50k, 100k, 200k)

Pass an evaluation and then purchase and start another of the same size

Mix Forex/CFD and Futures evaluations, as long as total allocations stay within limits

You cannot:

Have two active evaluations of the same size at the same time (e.g., 2x 100k)

Maximum Allocation Limits

Forex/CFD

Up to $2,000,000 total across active evaluations and funded accounts

Futures

Up to $775,000 in active evaluations

Up to $2,000,000 in funded accounts

Only one evaluation per tier size allowed at a time (e.g., 1x 100k, 1x 250k)

Once funded, you can continue compounding up to your cap. If you exceed the funded limit, new passed accounts are paused until space becomes available.

Yes. As long as you are trading within the permitted leverage and lot size (seen in your dashboard upon purchase) you may hedge positions on both sides. We want to give you wide capital trading opportunities.

We use the red folder news events from Forex Factory as a guideline for identifying impactful news. These events tend to have significant market impact, but we reserve the right to define what constitutes “news” on our platform.

During these events, traders are restricted from opening new positions within a 6-minute window – 3 minutes before and 3 minutes after the event. However, you can still manage existing trades, including closing positions, adjusting stop-losses, or moving trailing stops.

This rule is designed to prevent taking advantage of high-volatility conditions around news events.

Charges come across in the name of Dashboardanalytix.com.

When trading a Funded Account for our firm, you are treated as an independent contractor. As a result, you are responsible for any and all taxes on your gains.

Personal Information – Identity Documents

- Passport

- Government issued ID Card

- Drivers license

- Must not be expired

- Must have picture

- Both sides required

Proof of Address Documents

- The document was issued less than 3 month (by default) before the upload date.

- The document is not scratched, stained, or torn.

- The applicant full name, home address, and the document issue date (in most cases) information is present and readable.

- The document is issued either in paper or electronic (PDF) form.

PoA documents must contain:

- Owner full name and full home address.

- Issue date.

- Issuing authority identification data.

The PoA document photo to be uploaded should meet the following requirements:

- The file is an original photo (static image) or scan (not a screenshot or a photo uploaded from social networks) in JPG, JPEG, PNG, PDF.

- If the document has data on the front and back, the photos of both sides should be uploaded.

- The file size is under 50Mb.

- Information in the document is readable.

- All corners of the document are visible and no foreign objects or graphic elements are present.

- The uploaded photo has not been edited with any software or converted to PDF.

We utilize an aggregate source of pricing and liquidity from multiple brokers and liquidity providers. The current liquidity providers use a number of different tier 1 banks, prime brokers, market makers and other liquidity sources to derive their pricing, and those underlying liquidity providers change constantly. Aggregating liquidity providers while maintaining multiple sources of liquidity allows us to provide competitive pricing and execution, while reducing reliance on a sole liquidity provider.

All market pricing and trade executions are provided by the brokers, without any alterations or modifications on our part. Moreover, we do not adjust transaction costs such as bid-offer spreads, markups/markdowns or swaps beyond what is set by our brokers.

Please note that the composition of liquidity providers may vary depending on the trading platform.

Affiliates are given credit for introducing new Customers to your firm:

- Customers are registered to an affiliate during Customer Registration (i.e., when the Customer account is created). This is a separate process from Checkout.

- A Customer who creates an account that is NOT registered to an affiliate cannot be registered to an affiliate at a later point. At this point, they are no longer a new customer and therefore the affiliate has not introduced them to your firm.

A Customer who is registered to an affiliate will remain registered forever. An affiliate will receive affiliate credit for ALL orders from that customer for their lifetime.

Most of the FM prop trading firms offer a two step evaluation model. You have to pass the challenge, and then you need to pass the evaluation. You need to generate a certain amount of profit twice.

At Ment Funding we are transparent, and we are a one step evaluation prop firm (sometimes referred as one step challenge prop firm).

Your goal is to generate 10% profit following our rules.

Make sure you review the rules carefully and see how Ment Funding compares to other remote trading firms.

In some cases, traders may request to merge multiple funded accounts into a single larger account. Historically, this has been considered as a convenience for clients who held identical account sizes (for example, two $50K accounts combined into one $100K account).

To be eligible:

Both accounts must be funded (not in the evaluation stage).

Accounts should be at break-even or in profit.

Generally, only accounts of the same size are considered for merging.

Merging is not a guaranteed feature. Each request is reviewed on a case-by-case basis and must align with our risk management and operational frameworks. For this reason, account consolidation should be viewed as an exception rather than a standard offering.

If you were banned by another firm due to reasons beyond your control, such as the firm engaging in unethical practices or having operational issues, this does not automatically disqualify you from using our services. We evaluate each case individually and focus on the behavior of the trader, not the circumstances related to other firms. Therefore, you are welcome to try buying challenges with us, even if you were banned by other proprietary trading firms.

While we are aware that other firms may have their own blacklisting policies, we do not share or cross-reference blacklists with other firms unless the behavior in question involves serious violations of terms and conditions or fraudulent activity. We handle blacklisting internally and independently, ensuring that decisions are made based on our own Terms and Conditions and the evidence we have on hand.

This section serves as a warning and applies to your actions throughout the entire lifecycle of working with us, including all evaluations, assessments, and funded accounts. You are prohibited from using any trading strategy or engaging in any actions that are expressly prohibited by the Company or the Brokers it works with. Such prohibited trading (“Prohibited Trading”) includes, but is not limited to:

- Exploiting errors or latency in the pricing and/or platform(s) provided by the Broker

- Utilizing non-public and/or insider information

- Front-running of trades placed elsewhere

- Trading in any way that jeopardizes the relationship that the Company has with a Broker or may result in the canceling of trades

- Trading in any way that creates regulatory issues for the Broker

- Utilizing any third-party strategy, off-the-shelf strategy or one marketed to pass challenge accounts

- Utilizing one strategy to pass an assessment and then utilizing a different strategy in a funded account, as determined by the Company in cooperation with Prop Account, LLC at their discretion

- Utilizing Martingale or any average-down trading strategies, which are often not indicative of consistently profitable trading practices

- Attempting to arbitrage an assessment account with another account with the Company or any third-party company, as determined by the Company in its sole and absolute discretion

- “All-inning” – excessive risk-taking over and over again on one or over the span of multiple accounts (see rules item “Prohibited Gaming Practices” for more info)

If the Company detects that your trading constitutes Prohibited Trading at any stage of your participation – whether during evaluations, assessments, or as part of a funded account – your participation in the program will be terminated. This termination may include the forfeiture of any fees paid to the Company.

Furthermore, before receiving a funded account, all trading activity under these Terms and Conditions will be reviewed by both the Company and the Broker to ensure compliance. If Prohibited Trading is detected, the Trader will not receive a funded account.

The Company reserves the right to disallow or block any Trader from participating in the program for any reason, at the Company’s sole and absolute discretion.

To view all Prohibited Uses, please review our Terms and Conditions here: https://dashboardanalytix.com/client-terms-and-policies/?v=7516fd43adaa

We offer very competitive commissions across a wide range of products – including futures, FX, metals, energy, indices, and more.

You can find the full list of products along with their detailed commissions, contract sizes, and specifications here: https://mentfunding.com/commissions-and-products/.

This page is always kept up to date, so you’ll have full transparency on all trading costs.

Engaging in inappropriate risk management practices, such as gambling, “all-in” trading, or excessively leveraging positions, is strictly prohibited. Trading activity that resembles gambling, such as consistently placing trades prior to news releases or other binary events, will not be tolerated.

Excessive risk-taking and gambling are defined by the percentage of an account risked in a single trade or across a series of trades or positions. An “all-in” trade refers to committing all or a substantial portion of available capital or margin to a single trade. Similarly, excessive and improper use of leverage occurs when a trader risks a significant portion of their account in one trade or across a series of one-directional trades and positions.

If you are found to be engaging in such activities, we reserve the right to immediately close your account and such closure may include the forfeiture of any fees owed to you.

In rare cases, a trader may be banned or blacklisted from working with Ment Funding. This typically happens when our internal risk systems flag behavior such as excessive margin usage, highly concentrated positions, or inconsistent and overly aggressive position sizing.

As long as a trader avoids concentrated exposure, keeps margin usage within reasonable bounds, and remains compliant with maximum drawdown and all other risk limits, their trading strategy is fully acceptable. Traders who operate within these boundaries are free to trade, receive payouts, and scale capital repeatedly.

If a ban or blacklist decision is made, it is important to understand that all profits earned on the account up to that point have been paid out in full. Ment Funding does not withhold historical profits in these situations.

This serves as the only warning. Ment Funding does not issue multiple warnings, and once a ban or blacklist decision is finalized, it cannot be reversed except under extremely specific circumstances. Traders are expected to approach funded capital with discipline, consistency, and professional risk management, not with an all-in or reckless mindset.

We have a Consistency Requirement to ensure traders aren’t hitting profit targets through a few lucky trades.

This promotes consistent behavior and punishes YOLO-style trading. The calculation is: (best trading day PnL ÷ total PnL) × 100. A lower value means profits are generated more evenly across multiple trading days.

A higher value means profits are concentrated on fewer trading days. For example, a consistency requirement of 33% means you cannot achieve your entire profit target in less than 3 days (100% ÷ 33% ≈ 3).

You must meet both the profit target and the consistency requirement – maintaining a consistency ratio at or below 33% – to advance to the next phase.

In the Live Phase, there’s no profit target. The only requirement is consistency.

Once your Consistency Requirement is met, you can withdraw any amount you wish – there’s no minimum or maximum cap tied to profit targets.

No. But in order to complete the phase and be entitled to receive the payout, you will need to achieve both the profit target and the consistency requirement.

A futures contract represents a standardized amount of an underlying asset. For example, one E-mini S&P 500 futures contract (ES) represents $50 times the index price, while one crude oil (CL) contract represents 1,000 barrels of oil.

The total number of contracts you can hold at one time is limited by both your account size and the exchange margin requirements for each product. Your account balance must be sufficient to cover the required margin for all open positions.

You may have only one active Futures Evaluation account and one active Live Futures account per starting tier size at any given time. The available tiers are $25K, $50K, $100K, and $200K, $400K, which means you can hold up to five Evaluation accounts and five Live accounts simultaneously – one in each tier. In total, the combined starting balances of all your active accounts may not exceed $775,000.

Traders must trade the front-month contract for each product, as it has the highest liquidity and open interest. For example, in March, the correct contract for the ES E-Mini S&P 500 products is the March (H) contract – not July (N) or September (U). Trading out-month contracts is prohibited and may result in the loss of your account. Always ensure you’re trading the active front-month listed on the exchange.

To identify the most active front-month futures contracts, you can use CME Group’s Product Slate, which provides detailed information on all available contracts, including their current front-month status: https://www.cmegroup.com/markets/products.html

Trades can be placed starting at 6:00 PM EST at the Globex Open and can be held until the 4:10 PM EST session close.

Positions will be closed for you during regular trading days at 1510 CST. Trades cannot be held over weekends.

During holiday trading hours, auto-liquidation will not occur at the half-time market close, and the trader is responsible for closing the positions.

Please pay careful attention to market hours around holidays and shortened weeks. Failure to close the positions before the market closes may result in the loss of the account whether it is a Funded Futures or Live Futures account.

You are prohibited from using any trading strategy that is expressly prohibited by the Company or the Liquidity Providers it uses. Such prohibited trading (“Prohibited Trading”) shall include, but not be limited to:

- Exploiting errors or latency in the pricing and/or platform(s) provided by the Liquidity Provider/Exchange

- Utilizing non-public and/or insider information

- Front running of trades placed elsewhere

- Trading in any way that jeopardizes the relationship that the Company has with a Liquidity Provider/Exchange or may result in the canceling of trades

- Trading in any way that creates regulatory issues for the Liquidity Provider/Exchange

- Utilizing any third-party strategy, off-the-shelf strategy or one marketed to pass challenge accounts

- Attempting to arbitrage a funded account with another account with the Company or any third-party company, as determined by the Company in its sole and absolute discretion.

- No Gambling Permitted: When participating in trading on both Challenge and Instant Funded Accounts, traders are expected to adhere to responsible risk management practices. This includes carefully considering the risks associated with position size, trade duration, and hedging strategies. Taking excessive risks, such as utilizing maximum leverage to open large positions with the hope of reaching profit targets through a single price movement, is strictly prohibited. Please refer to the Terms and Conditions for the full Prohibition of Gambling Practices language.

- If the Company detects that your trading constitutes Prohibited Trading, your participation in the program will be terminated and may include forfeiture of any fees paid to the Company. Additionally, and before any Trader shall receive a funded account, the trading activity of the Trader under these Terms and Conditions shall be reviewed by both the Company and the Liquidity Provider/Exchange to determine whether such trading activity constitutes Prohibited Trading. In the case of Prohibited Trading, the Trader shall not receive a funded account.

- Compliance with CME Group Rules: All trading activities must adhere to CME Group’s rules and regulations.

- Additionally, the Company reserves the right to disallow or block any Trader from participating in the program for any reason, in the Company’s sole and absolute discretion.

To view all Prohibited Uses, please review our Terms and Conditions here, https://dashboardanalytix.com/client-terms-and-policies/

Our futures program does not prohibit trading during news events; however, traders must exercise heightened caution due to the increased volatility and reduced liquidity that often accompany such events. Traders are solely responsible for staying informed of scheduled economic news releases and managing their positions accordingly.

You can see the full list of products and commissions here – https://mentfunding.com/commissions-and-products/

E-mini S&P 500 – ES

CME Micro E-mini S&P 500 – MES

CME E-mini Nasdaq-100 – NQ

CME Micro E-mini Nasdaq-100 – MNQ

CME E-mini Dow Jones – YM

CBOT Micro E-mini Dow Jones – MYM

CBOT E-mini Russell 2000 – RTY

CME Micro E-mini Russell 2000 – M2K

CME Euro FX – 6E

CME British Pound – 6B

CME Japanese Yen – 6J

CME Canadian Dollar – 6C

CME Swiss Franc – 6S

CME Australian Dollar – 6A

CME Crude Oil – CL

NYMEX Micro Crude Oil – MCL

NYMEX Natural Gas – NG

NYMEX Heating Oil – HO

NYMEX RBOB Gasoline – RB

NYMEX Gold – GC

COMEX Micro Gold – MGC

COMEX Silver – SI

COMEX Micro Silver – SIL

COMEX Platinum – PL

NYMEX Copper – HG

COMEX Corn – ZC

CBOT Soybeans – ZS

CBOT Soybean Meal – ZM

CBOT Soybean Oil – ZL

CBOT Wheat – ZW

CBOT Micro Bitcoin – MBT

CME Micro Ether – MET

When you purchase a Futures Evaluation plan, you will receive credentials that grant you access to a Rithmic R|Trader account. These same credentials can also be used to connect to the Rithmic data feed through supported third-party platforms such as Quantower, Bookmap, and others that are Rithmic-compatible.

Please note that while we provide access to the Rithmic infrastructure, we do not offer user support for R|Trader, Rithmic, or any third-party platforms. For any technical issues or platform-specific questions, you’ll need to contact the respective technology provider directly.

What happens when I meet the doubling conditions?

Once you meet all the conditions listed below, you’ll be paid out your profit split based on the profits left in the account. After that, the account will be closed and you’ll receive a brand new LIVE account with double the previous size.

Example: You’re on a $100,000 account. By the time you meet all requirements, the account has grown to $140,000. You get paid your profit split from the $40,000 gain, the $100,000 account is closed, and you’re issued a brand new LIVE $200,000 account with a 6% max loss. It’s a fresh account, just twice the size.

Requirements to Qualify:

Withdraw at least once on the account (we only start tracking once a withdrawal has been made).

Out of any 6-month period, at least 3 months must show a gain of more than 2% (they don’t need to be consecutive).

Total profits (current profit + any payouts on the account) must reach at least 10% of your starting balance.

Does this apply to both Forex and Futures accounts? Yes. These rules apply to both the Forex and Futures funding programs. Each is treated separately – you can max out funding on both sides independently.

Maximum Funding Limits:

You can scale up to $5,000,000 on the Forex side.

You can also scale up to $5,000,000 on the Futures side.

That means you can hold $1 million in funding on Forex and $375k on Futures, and still be eligible to scale both to their respective caps.

The Max Loss is static and calculated ONLY on the initial Balance. For example, on a $100,000 account, the account can only be breached if it goes below $95,000 (5%). So if your balance grows to $107,000 on a $100,000 account, the Max Loss is still $95,000 (5% from the original balance).

Important Note: The Max Loss moves to the initial balance after the first withdrawal – incentivizing our funded traders to compound and grow their accounts before withdrawing huge earnings (please see below example).

Example: If you have a $200,000 account, the Max Loss Breach level would be $190,000. If you then traded your account up to $215,000, the Max Loss Breach level would still be $190,000 (5% of the initial balance). If you then withdrew $10,000 as profit, upon your first withdrawal, the Max Loss locks in at the ORIGINAL account balance. So after withdrawing $10,000, your account will have a balance of $205,000 and the breach level is now $200,000, meaning you now have a buffer of $5,000. Similarly, if you withdrew $10,000 more (total $20,000), your account balance would now be $195,000, which is below the $200,000 breach level, meaning you would lose your funded account.

Further Example: If you continued to compound your $200,000 all the way to $300,000, the Max Loss Breach Level is still $190,000. However, if you then withdrew $50,000 profit, the Max Loss will lock in at $200,000, meaning you would now have $50,000 as a buffer (Max Loss).

We have included this rule to incentivize our funded traders to compound their accounts, ensuring that they have a hefty buffer, can pay themselves out as they see fit, and continue trading with Ment Funding as a Ment Funded member.

The Max Daily Loss is subtracted from end-of-day balance. It is the maximum your account can lose in any given day. Withdrawing profit on your funded account does not affect the Max Daily Loss.

Max Daily Loss is calculated using the previous day’s balance, which resets (re-calculates) at 5 PM EST. Unlike other prop firms, we do not base our calculations on previous day equity. This balance-only model allows you to scale profits without fear of losing your account. The Max Daily Loss compounds as your account grows.

For example, on a $100,000 account, the Max Daily Loss = $97,000 ($100,000 – $3,000 [3% Max Daily Loss] = $97,000).

So if your equity on any given day is $106,000 but your balance is still $100,000, the Max Daily Loss breach level is still $97,000. If you close the trade in profit before 5 PM EST, then at 5 PM EST the calculation resets and the Max Daily Loss = $102,880 ($106,000 – $3,180 [3% Max Daily Loss]).

This is also updated and shown in your Trader Dashboard along with other metrics so you can keep track of it with no issues.

Another Example: If your prior day’s end-of-day balance (5 PM EST) was $100,000, your account would violate the daily stop loss limit if your equity dropped to $97,000 during the day. If your floating equity is +$5,000 on a $100,000 account, your new-day (5 PM EST) Max Daily Loss is based on the previous day’s balance ($100,000). So, your daily loss limit would still be $97,000.

We offer very competitive commissions across a wide range of products – including futures, FX, metals, energy, indices, and more.

You can find the full list of products along with their detailed commissions, contract sizes, and specifications here: https://mentfunding.com/commissions-and-products/.

This page is always kept up to date, so you’ll have full transparency on all trading costs.